Menu

Market Overview

The hydraulic accumulator industry crossed a major milestone in 2025, reaching $2.05 billion in global value. This marks a significant recovery from pandemic disruptions and signals strong momentum for the next decade. The market is projected to grow from $2.05 billion in 2025 to $3.56 billion by 2034, driven by automation demands across construction, mining, and manufacturing sectors.

Three Major Developments Reshaping the Landscape

- Smart hydraulic systems with integrated electronics saw a 39% increase in adoption across agriculture and mobile equipment in 2024.

- Construction and mining equipment sectors now account for over 35% of global demand.

- Asia Pacific commands nearly 44% of global hydraulic accumulator usage, fueled by urbanization and infrastructure expansion.

But it's not all smooth sailing. Oil leak issues account for 48% of performance-related failures in construction and mining equipment, creating both operational headaches and environmental concerns.

Modern construction equipment relies heavily on advanced hydraulic accumulators to maintain efficiency and performance in demanding conditions.

Why This Matters Now

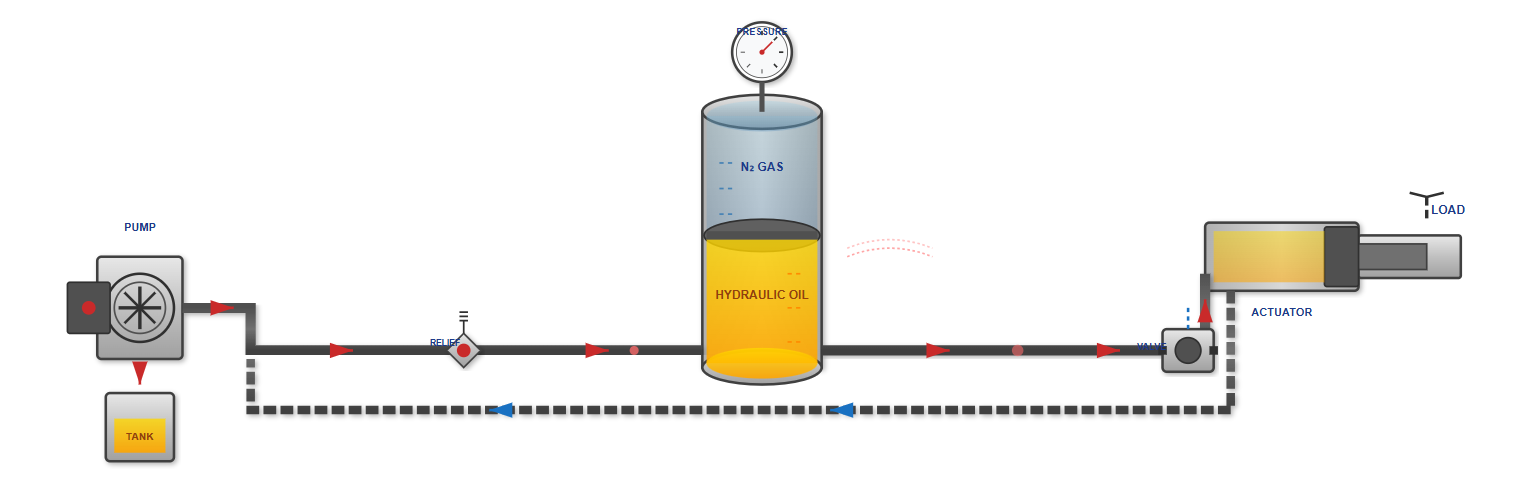

Hydraulic accumulators store pressurized fluid and release it when your equipment needs extra power. Think of them as batteries for hydraulic systems.

The market shift comes down to three forces converging in 2025. Manufacturing automation is accelerating faster than many predicted. Construction equipment is getting smarter, not just bigger. And mining operations are under pressure to improve both efficiency and environmental compliance.

The market is projected to grow from $1.42 billion in 2025 to $1.69 billion by 2032, exhibiting a CAGR of 2.9% according to industry analysts at intelmarketresearch.com. However, other market researchers at businessresearchinsights.com project more aggressive growth, citing over 62% of the demand rise driven by increased investment in automated material handling equipment across mining and automotive sectors.

Five Pain Points Driving the Market

Equipment Downtime

Every hour your excavator sits idle waiting for hydraulic pressure to build is revenue lost.

Energy Efficiency Regulations

Your hydraulic systems need to do more with less power.

Oil Leaks

Oil leaks create environmental liabilities. One leak can shut down operations and trigger regulatory fines.

Labor Costs

You need equipment that works smarter, not systems that need constant manual intervention.

Pressure Spikes

Unpredictable pressure spikes damage expensive components. Without proper energy storage, your hydraulic systems take a beating.

What's Actually Happening in the Industry

Construction and Mining Take the Lead

The construction sector isn't just buying hydraulic accumulators anymore. They're demanding sophisticated energy management systems.

Construction and mining equipment sectors account for over 35% of global demand, followed by the automotive industry with 28% market share. This shift reflects how these industries have embraced automation and efficiency improvements.

Excavators, cranes, and loaders need consistent hydraulic pressure to handle heavy loads without putting stress on the pump. Accumulators provide that buffer, storing energy during low-demand periods and releasing it during peak operations.

The mining sector presents unique challenges. Equipment operates in harsh conditions with extreme temperature variations. Piston hydraulic accumulators play a crucial role in high-pressure applications and are essential in heavy-duty industries, such as oil and gas, mining, and construction. Their robust construction supports longer operational lifespans in demanding environments.

Smart Technology Integration

The biggest news in 2025 is how quickly smart technology is penetrating the market.

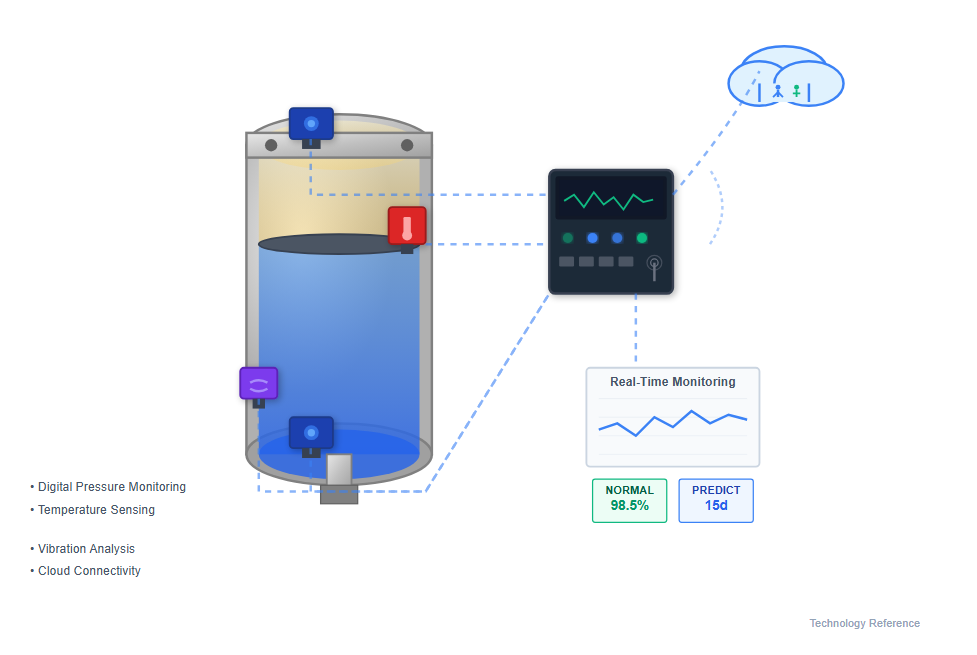

In early 2024, Bosch Rexroth introduced a series of digital hydraulic accumulators that leverage IoT technology for real-time monitoring and predictive maintenance. This represents a fundamental shift from passive energy storage to active system management.

What does "smart" actually mean for hydraulic accumulators? Real-time pressure monitoring tracks system performance continuously. Predictive maintenance algorithms flag potential failures before they happen.

Regional Power Shifts

Geography matters more than ever in this market.

Asia Pacific accounts for nearly 44% of global hydraulic accumulator usage, fueled by urbanization, construction growth, and mining machinery demand. China and India drive this growth through massive infrastructure projects and expanding manufacturing bases.

Asia Pacific leads the market, accounting for approximately 38% of the global market share in 2024, with a market value of $699 million reports growthmarketreports.com. The region expects the highest growth rate through 2033, reflecting strong industrial momentum.

Asia Pacific

44%

Global market share

Driven by urbanization, infrastructure development, and manufacturing expansion in China and India.

North America

27%

Global market share

Focused on innovation and sustainability, with strong presence of leading equipment manufacturers.

Europe

22%

Global market share

Technology leadership in advanced accumulator designs with focus on energy efficiency.

Deep Dive: Market Dynamics Reshaping the Industry

Technology Types and Market Share

Understanding which accumulator types dominate helps predict future trends.

Bladder, piston, and diaphragm accumulators form 87% of product share. Each type serves specific applications based on pressure requirements, size constraints, and operational conditions.

-

Bladder accumulators: Offer cost-effectiveness and quick response to pressure changes. Ideal for compact spaces.

-

Piston accumulators: Excel in high-pressure applications and harsh environments with longer operational lifespans.

-

Diaphragm accumulators: Provide contamination-free operation, ideal for food processing and pharmaceutical applications.

Industry Applications Driving Growth

Different industries use hydraulic accumulators for different reasons.

Construction & Mining

35% of total market demand, used in excavators, cranes, and heavy machinery.

Automotive Manufacturing

28% of total market demand, used in press operations and robotic assembly.

Agriculture

18% of total market demand, integrated into modern farm equipment.

Renewable Energy

10% of total market demand, used in wind and solar installations.

Food & Pharmaceutical

9% of total market demand, requiring contamination-free systems.

Competitive Landscape and Market Leaders

A few major players control significant market share through comprehensive product portfolios and global distribution networks.

Parker-Hannifin and Bosch Rexroth contribute over 36% of the total market activity based on product launches and geographic expansions. These companies invest heavily in research and development to maintain technological leadership.

Regional players are gaining ground through competitive pricing and localized production. The Asia-Pacific market sees growing influence from Eagle Industry and NACOL, which have successfully expanded beyond domestic markets through competitive pricing and customization capabilities for construction equipment applications.

Top Market Players

1

Bosch Rexroth

18% market share

2

Parker-Hannifin

17% market share

3

Eaton

12% market share

4

HYDAC

9% market share

5

Freudenberg

7% market share

Recent Strategic Moves

APR

2025

Kawasaki Heavy Industries Expansion

Established PT Kawasaki Precision Machinery Indonesia to boost sales of hydraulic products in Indonesia amid rising demand from infrastructure growth and mining.

FEB

2023

Bosch Rexroth Acquires HydraForce

Completed acquisition after receiving antitrust approval, expanding capabilities in cartridge valves and hydraulic integrated circuits, strengthening position in compact hydraulics.

What You Need to Know: Key Questions Answered

Looking Ahead: What This Means for Your Business

The hydraulic accumulator market evolution presents both opportunities and requirements for equipment owners and operators.

Near-term Implications

- Expect continued price pressure on traditional accumulator designs as smart technology becomes standard.

- Equipment replacement cycles should factor in technology advances that offer 30% better energy efficiency.

- Supply chain considerations matter more now, with lead times for specialized accumulators stretching to 12-16 weeks.

Long-term Strategic Considerations

- Industry consolidation will continue, creating opportunities to negotiate better terms with suppliers.

- Standards and regulations will tighten around energy efficiency and environmental performance.

- The convergence of hydraulics and electronics reshapes skill requirements for maintenance teams.

Bottom Line

The hydraulic accumulator market is experiencing its most significant transformation in decades. The combination of smart technology adoption, geographic market shifts, and application diversity creates both opportunity and complexity.

For equipment owners, the path forward requires balancing innovation with practical economics. Smart accumulators deliver measurable benefits in the right applications. But successful implementation demands proper system integration, trained personnel, and commitment to data-driven operations.

The $2.05 billion market in 2025 represents just the beginning of a decade-long growth trajectory. Companies that understand these dynamics and adapt their procurement and maintenance strategies will capture competitive advantages in reliability, efficiency, and operational intelligence.

Pay attention to three trend indicators: smart technology adoption rates in your industry, regional supply chain developments affecting delivery times, and consolidation moves by major manufacturers. These signals will help you time equipment upgrades and supplier negotiations for maximum benefit.

Market Data & Forecast

Global Market Growth

Key Market Metrics

CAGR (2025-2034)

6.2%

Smart Technology Adoption

39% YoY Growth

Failure Rate from Oil Leaks

48%

Market Drivers

- Automation demands in manufacturing

- Smart construction equipment adoption

- Infrastructure development in Asia Pacific

- Energy efficiency regulations

Related Resources

Industry Experts

Jane Smith

Hydraulics Engineer, Bosch Rexroth

Michael Chen

Market Analyst, IntelMarketResearch

Sarah Johnson

Industry Consultant, Construction Tech